Section 179 calculator

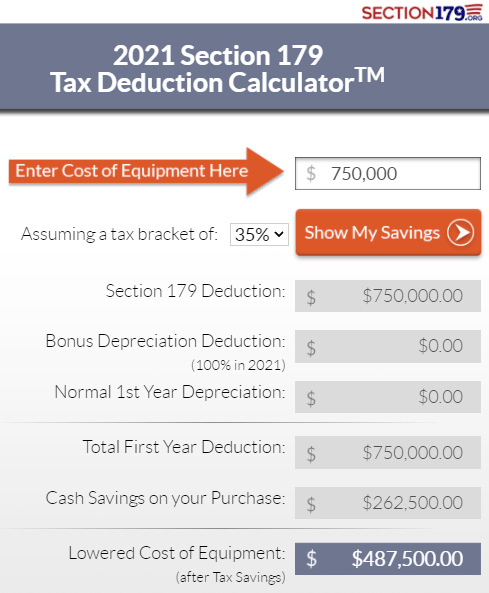

Heres an easy to use calculator that will help you estimate your tax savings. Section 179 Deduction Limits for 2021.

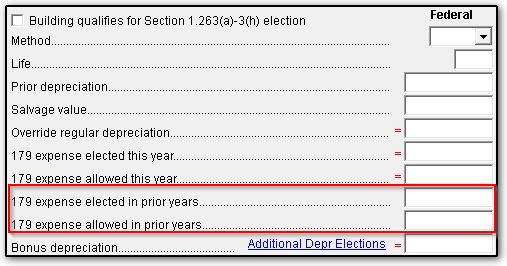

4562 Section 179 Data Entry

Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

. Today Section 179 is one of the few government incentives available to small businesses and has been included in many of the recent Stimulus Acts and Congressional Tax Bills. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Under the Section 179 tax deduction you are able to deduct a maximum.

Make your pharmacy more productive profitable when you use this tax benefit with Parata. The Section 179 Tax Deduction allows a business to deduct all or part of the purchase price of certain qualifying equipment that is leased or financed. Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021.

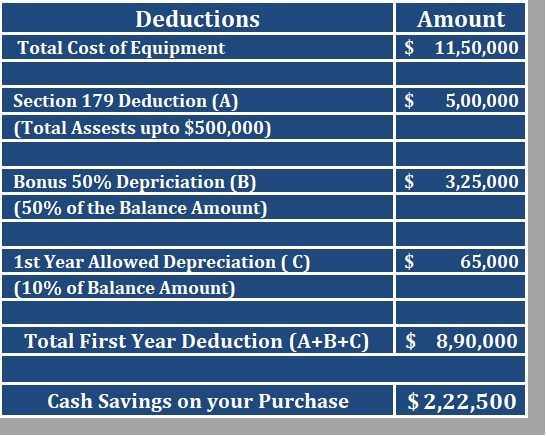

We have created some useful templates in excel to help simplify the process of calculating. Take a look at our Section 179 Deduction Calculator to get an estimate of just how much Section 179 can save when financing equipment for your business in the current year. There is also a limit to the total amount of the equipment purchased in one year.

Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. Tax deduction If a company purchases more than 2000000 in a single tax year and elects the 179 tax deduction the 179. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly.

Use Our Section 179 Deduction Calculator To Find Out. Qualified purchases can be written off as an expense during. SIGN YOUR APPROVAL FOR.

The total amount that can be written off in Year 2020 can not be more than 1040000. In addition there are IRS tax forms and also tools for you to use such as the free Section 179 Deduction Calculator currently updated for the 2022 tax year. Section 179 calculator for 2022.

The Section 179 deduction limit for 2021 is 1050000. Simply enter in the purchase price of. Companies can deduct the full price of qualified equipment purchases up to.

Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and. Use Our Section 179 Deduction Calculator To Find Out. Section 179 allows you to subtract the cost of certain types of assets from your balance sheet.

Section 179 can save your business money because it allows you to take up to a 1080000 deduction when purchasing or leasing new machinery. You can use this Section 179 deduction calculator to estimate how much tax you could save under Section 179. Limits of Section 179.

This limit is set by the IRS and is listed in our 179 tax calculator. This easy to use calculator can help. Calculate your potential savings.

The Section 179 deduction limit for 2022 has been raised to 1080000. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and. Section 179 Calculator for 2022.

Your company is allowed to deduct the full cost of equipment either new or used up to 1080000 from 2022s. To download Section 179 deduction calculator in Number for Mac users click on the link below. When you acquire equipment for your.

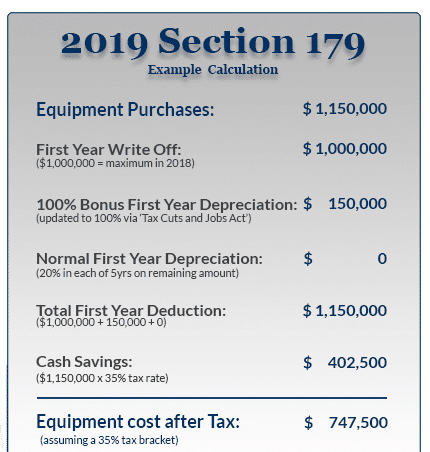

Section 179 does come with limits there are caps to the total amount written off 1080000 for 2022 and limits to the total amount of the equipment purchased. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Example Calculation Using the Section 179 Calculator.

The Section 179 Deduction has a real impact on your equipment costs. This means your company can deduct the full cost of qualifying equipment new or used up to. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

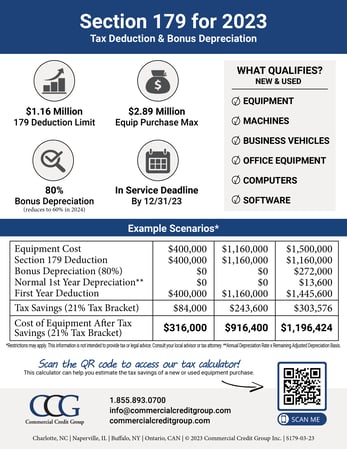

Section 179 Calculator Ccg

Free Self Employment Tax Calculator Shared Economy Tax

Section 179 Depreciation Tax Deduction 2014 Taycor Financial

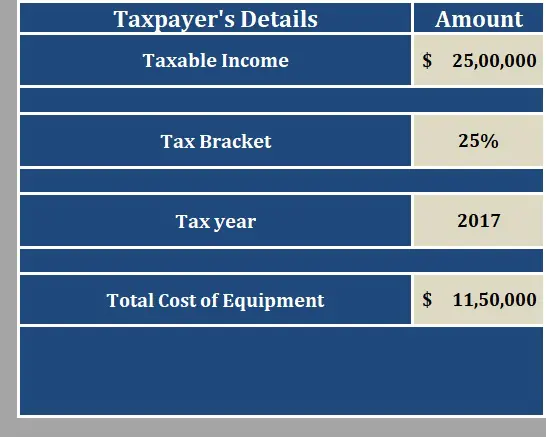

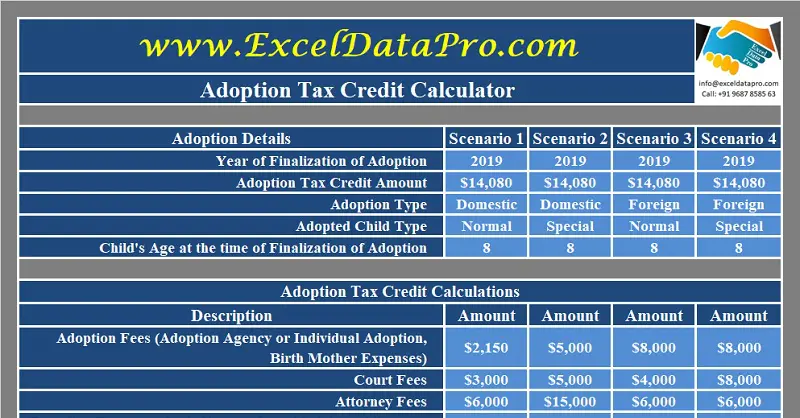

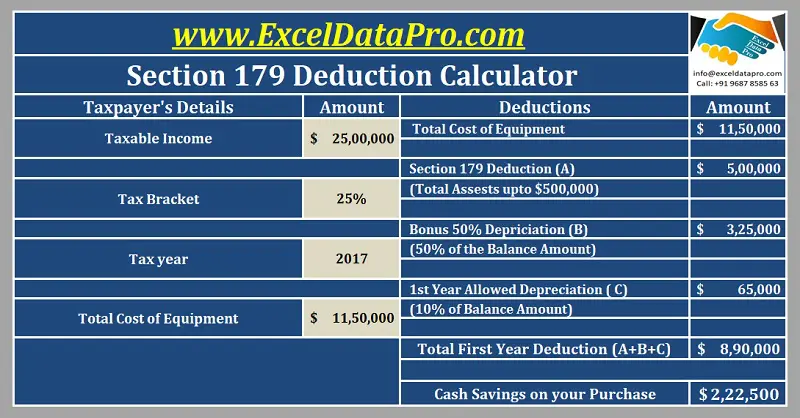

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Write Off Your Entire Purchase In 2020 With Section 179 Deduction Advancedtek

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

2021 Section 179 Tax Savings Your Business May Deduct 1 050 000 Youtube

Download Section 179 Deduction Calculator Excel Template Exceldatapro

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Bellamy Strickland Commercial Truck Section 179 Deduction

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Section 179 Calculator Ccg

Smart Dtg Printer Owners Take Advantage Of The Section 179 Tax Deduction Ricoh Dtg

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Section 179 Tax Deduction Official 2019 Calculator Crest Capital

Download Section 179 Deduction Calculator Excel Template Exceldatapro

The Current State Of The Section 179 Tax Deduction